Scenario 3

Bill Gold has a successful lawn-care business and a 20-hour-a-week job at a garden shop. Bill believes that the social security system will not exist by the time he is ready to retire. He feels that citizens should be allowed to save their own money for retirement instead of being required to pay social security tax from their income. He grudgingly accepts that social security taxes must be deducted from his paycheck from the garden shop. However, he does not pay social security on the income he makes from his lawn care service.

Bill’s wife, Shirley, is a hair stylist. She does not report all her tips to the IRS. Shirley is concerned that the IRS will discover that she and Bill are not reporting all their income and that the government will expect Bill to pay social security tax on his lawn care income. She raises this concern with Bill saying, ‘I worry that the IRS will audit our income tax returns. Your business has grown rapidly, and they might decide to trace all our earnings.’

Bill reassures Shirley, saying, ‘How can the government keep accurate records on millions of people?’ he goes on to say that records of cash payments cannot be traced and that even if the IRS catches on to him, he will be able to produce records of enough business expenses to offset any income received. Shirley accepts Bill’s explanation but still worries that what they are doing is unethical and that an audit would result in hefty fines and a requirement to pay back taxes.

Items for Consideration

1. What is the rationalization in this case?

2. Instead of hoping that the government does not find out about Bill’s lawn-care earnings, what should Bill and Shirley do? (Remember, Bill feels he can show enough expenses to offset income.)

3. Are Bill and Shirley’s actions ethical? Are they legal? Why or why not?

4. Will Shirley also be in trouble if Bill’s income tax return is audited, even though it involves his lawn-care business?

5. Do you believe that today’s workers should be required to pay social security taxes even though this fund may run out by the time they retire?

6. What alternatives to social security might be possible?

7. Can individuals like Bill take it upon themselves to choose an alternative way to save for retirement instead of social security? Why or why not?

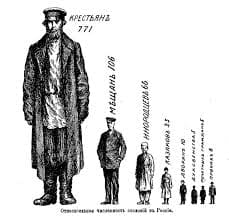

Taxes throughout Russian history

2020-09-24

2020-09-24 102

102