April 3, 2014

Dr Abhishek Deshpande and Nic Brown

Natixis

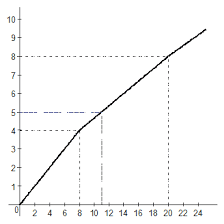

One of the key drivers of the oil markets is the price at which principal OPEC producers balance their government accounts – better known as fiscal break-even oil prices. By monitoring the fluctuations of these break-even prices in major oil-producing countries such as Saudi Arabia, Iran, Iraq, Kuwait and the UAE, we can assess potential changes in OPEC’s desired level of global oil prices.

Saudi Arabia

Due to higher spending and a decline in crude exports, Saudi Arabia’s fiscal break-even oil price rose higher than expected last year.

Over the medium-term, Saudi Arabia is likely to face escalating pressure to reduce its oil output, paving the way for other OPEC members to increase their own production. Curtailing output, however, is likely to raise Saudi’s fiscal break-even oil price and force the government to rein in public spending, or risk a temporary budget deficit. Already, various stimulus packages introduced in response to the 2008 global financial crisis and Arab Spring have been wound down – causing economic growth to weaken.

Estimates point to a reduction of 200,000 barrels per day (b/d) in oil output and exports during 2014, which will sharply increase Saudi Arabia’s fiscal break-even oil price to approximately $97 per barrel (bbl). Coupled with mounting domestic fiscal pressure, tensions among OPEC members could be amplified as the debate over individual country output quotas is put in the spotlight.

Despite the risk of rising non-OPEC supply depressing the overall daily call on OPEC output, we would still expect Saudi Arabia to scale back production so other member states can increase their supply. The extent of this scaling back, however, will depend on the level at which the more disrupted OPEC producers increase their output, particularly as several of these countries face ongoing sectarian, political and terrorism-linked disruptions.

Iran

Iran’s oil exports fell to less than 1 million b/d in August 2012, largely due to the EU embargo and US sanctions against the major importers of Iranian oil. Exports remained at this level throughout 2013, compared with an average of 2.2 million b/d in 2011. In January 2013, Iran's oil minister acknowledged that the fall in exports cost the country between $4 billion and $8 billion each month. It’s believed Iran suffered a loss of around $26 billion in oil revenue during 2012. In the same year, Iran’s fiscal break-even oil price shot up by $26/bbl year on year (yoy).

Iran’s fiscal break-even oil price is expected to retreat this year due to projected increases in oil exports and non-oil revenue, as well as efforts to restrict government expenditure, bringing the country’s fiscal break-even oil price down from around $132/bbl (2013) to $126/bbl. This is based on the assumption that US sanctions will remain in place and non-oil revenues will increase by 8% yoy. According to the US government, Iran's oil exports will remain at the current level of around 1 million b/d – excluding natural gas liquids (NGLs) – during the six months of the interim nuclear agreement. However, US officials estimate that Iran will accrue $1.5 billion during that period from sales of petrochemicals, trading in gold and other precious metals and renewed trade with foreign firms in the automotive sector.

If US sanctions on Iranian exports of crude are lifted completely, however, fiscal break-even oil prices could retreat significantly. Over the medium-term, Iran offers positive prospects for international oil companies – but only if the government is willing to grant attractive deals to foreign oil companies to revive its economy. Furthermore, the country’s plans to increase oil production and exports are somewhat ambitious given the poor state of its infrastructure. As such, these plans are likely to take longer than predicted.

Iraq

Iraq’s proposed budget – currently delayed due to the ongoing dispute over the Kurdish Regional Government’s share – plans expenditure of around $150 billion, assuming that oil prices will average $106.10/bbl. If prices were to drop below $106/bbl, this could result in a budget deficit. Our forecast for Brent crude is around $107-108/bbl this year, with possible downside risks.

We expect Iraqi oil exports to increase by just over 200,000b/d in 2014 and around 300,000b/d in 2015, bringing Iraqi fiscal break-even oil prices to $103.40/bbl and $105.10/bbl respectively. Growth in oil exports is expected to remain in line with that of domestic oil output, but will depend significantly on the development of Iraq’s oil export infrastructure.

Kuwait

While Kuwait’s oil production grew by just 1% in 2013, an unexpectedly large increase in crude exports helped to drive their fiscal break-even oil price down to just $54/bbl. For 2014, our estimate is based on predictions of a 60-70,000b/d increase in crude output and a 15% increase in budget expenditure. This suggests a fiscal break-even oil price of $61/bbl.

The International Monetary Fund (IMF) expects Kuwait’s economic outlook to ‘improve further’ in the years ahead, with a ‘moderate increase in oil production’. In fact, Kuwait plans on increasing overall crude oil output to 4 million b/d by 2020 (from its current production rate of approximately 3 million b/d).

UAE

Turning to the UAE, growth in government spending has fallen significantly – from around 17% per annum between 2003 and 2013 to just 3-5% in the past two years. Meanwhile, the government expects oil production to rise steadily to 2.907million b/d in 2015, with another 500,000 b/d arriving from NGL production. Assuming a modest increase in this year’s output – 50,000b/d, instead of the 120,000b/d seen in 2013 – with exports rising by 16,000b/d (versus 60,000b/d in 2013), we would expect the UAE’s fiscal breakeven oil prices to rise to $88.7/bbl in 2014.

Lower forecasts for 2014

Collectively, these five key OPEC crude oil producers have an output-weighted fiscal break-even oil price of around $93.3/bbl for 2014. Kuwait and the UAE have the lowest fiscal break-even oil prices, owing to high levels of oil production and exports relative to the size of their population.

Our forecasts have in fact been revised downwards from last year’s prediction (by $3.8/bbl), largely because there will be lower break-evens for Saudi Arabia as a result of its slower growth in expenditure. The UAE and Kuwait will also experience lower break-evens, due to increased oil output, as will Iran – as sanctions are slowly lifted and exports resume. Crucially, the rate at which Iranian oil returns to the markets will determine the extent to which key GCC countries will be required to scale back their oil production and export targets in order to accommodate Iran’s potentially significant increase in crude exports.

About the authors

Dr.Abhishek Deshpande and Nic Brown are commodities analysts at Natixis.

2015-08-21

2015-08-21 519

519