| 1) alliance | getting control of a company by buying over 50% of its shares |

| 2) joint venture | two or more companies joining to form a larger company |

| 3) LBO (leveraged buyout) | what stocks in a public company are worth |

| 4) MBO (management buyout) | a business activity in which two or more companies have invested together |

| 5) merger | when a company's top executives buy the company they work for |

| 6) takeover / acquisition | an offer to buy |

| 7) shareholder value | additional advantages, profits that are produced by two organizations combining their ideas and resources |

| 8) bid | buying a company using a loan borrowed against the assets of the company that's being bought |

| 9) vertical integration | controlling all stages of one particular type of business |

| 10) synergy | an agreement between two or more organizations to work together |

H. Work in pairs. Imagine that you work for a small company which has just been bought by a big multinational. Discuss the following questions:

1) Where the various potential culture clashes may occur?

2) How you think you personally would adapt to the new culture?

3) What could be done by both companies to ensure smooth transition from one corporate culture to another?

Reading 3: Takeover

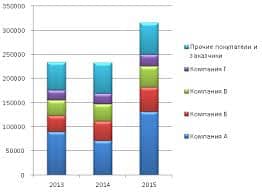

2015-07-14

2015-07-14 846

846