The shadow economy into the world economy.

© 2014 г. N.V. Zelenin

Lobachevsky State University of Nizhny Novgorod

Consider the concept of the shadow economy and shadow finance, sources of origin of the term, and the role of this concept in the modern world. It is a mistake to believe that the impact of the shadow economy is exposed only the Russian Federation. Unfortunately, often sounding to the Russian economy the term «corruption» is applicable not only to our country. More or less this affects all countries of Europe and Asia, and even the United States - one of the strongest economies in the world.

The shadow economy is now one of the major problems of the world community, the solution of which depends directly on the «health» of the national economy, the level of law and measure of welfare. The history of informal economic activity - is, above all, the element of history commodity-money relations. The development of the shadow economy is directly proportional to force regulation of economic activity. Bursts of shadow economic activities were the turning points of economic history.

In domestic science and practice of economic interest in the informal sector is clearly evident in the 80's. This was due to the socio-economic factors and ideological. Last appeared in fostering leadership studies aimed at identifying strains and discredit the command of socio-economic system of state socialism.

The shadow economy is an economic activity, which develops outside state control and accounting, and therefore, is not reflects in official statistics. Shadow (informal, hidden) economy is an existing reality of world and domestic economy, covering all spheres of the society. Its share in GDP of different countries, it is estimated to be between 5-10% to 50-60%.

The shadow economy is formed due to the existence of conditions that may be beneficial to conceal their economic activities from a wide range of people. The scale of concealment can be different - from hiding the very existence of the company or of the existence of certain assets, to hide certain transactions.

«The National Institute for System Studies of enterprise» (NISSE) proposed version of the reason for the «Fade»[1]:

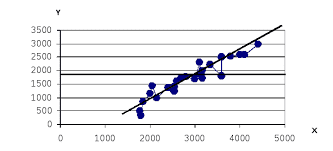

The main reason for leaving the shadows was and still is high tax rates. The most important "non-tax factor" respondents believe corruption of the state apparatus, "informal payments" in obtaining licenses, certificates, permits require a unaccounted cash. Figure 1 shows the main items of shadow payments.

Figure 1 Share of firms use the shadow of payment for various items

To understand the causes of the shadow economy, it is necessary to analyze the economic benefits that will get the company or entrepreneur, decided to leave the shade and legally conduct business, and vice versa. Some economists believe that high taxes - is not the main reason for leaving the shade. So Johnson, Kaufman and Slate believe that institutional aspects are even more important in the transition to the informal sector. In his studies of the less developed countries, countries in transition and developed countries, they conclude that the key determinant of the transition to a shadow of regulatory restrictions. When laws and legislation is weak, the authorities are allowed to make decisions without any control. This entails the corruption, which in turn makes the business go into the shadows. The main factor in the appearance of the shadow economy is presented in Figure 2.

Figure 2 Factors appearance of the shadow economy

Depending on the development of market relations in the economy in general, the causes of the shadow economy will be greater or less degree of influence of several of them will vary. The development of the shadow economy affects economic freedom, bordering on moral permissiveness strain of ethical requirements.

In the early 2000's in developed countries, the shadow economy was equivalent to an average of 15% of GDP in transition countries - 23% in developing countries - 39%. Table 1 shows the countries with the highest % of GDP[2].

Table 1. Percentage of GDP in different countries

| Country | % GDP |

| Greece | 29,0 |

| Italy | 27,8 |

| Spain | 23,4 |

| Belgium | 23,4 |

| Ireland | 14,9 |

| Canada | 15,8 |

| France | 16,3 |

| Austria | 9,1 |

| USA | 8,9 |

| Switzerland | 8,0 |

| Russia | 46 (Ministry of Interior data), 23 Russian Statistics Department, Rosstat |

The close relationship between the shadow economy and corruption suggest I.Klyamkin L.Timofeev. In their view, «the main and most obvious feature of the shadow economic relations in Russia is that they are fundamentally inseparable from corruption». I.Klyamkin L.Timofeev and emphasize that «underground economy» is not opposed to the economy of the «formal», but also closely integrated into it. In other words, the basis of illegal economic relations in Russia is to privatize any public good (in particular, any law) and put it in the shadow turnover. The shadow economy in Russia, thus, acts as a privatized state[3].

Talking about the shadow economy, it is necessary to refer to the transition of formal to informal finance, which actually corresponds to the concept of «money laundering». This is an activity carried out in order to «purify» the illegal income, and separate them from criminal activity, which allowed them to receive, thus making it difficult to establish their source. Specifically, money laundering - a series of actions aimed at the return of the economic and financial market money or other securities of illicit origin, representing the acquisition and possession of legitimate and normal. It is also the legalization of funds obtained by illegal means, that is, their translation of the shadow, the informal economy into the formal order to be able to use these funds openly and publicly. When money is hiding the true source of income, the substitution of actual transactions formal transactions distorted economic sense, with the initial stage of money laundering can be tampered documents, documents of third parties used for the final legalization of using legal provisions and many others.

Broadly speaking, the circuit can be represented as follows:

1. Crime

· Corruption and bribery;

· Fraud;

· Organized crime;

· drug and human trafficking;

· Environmental crimes;

· Terrorism;

· Other serious crimes.

2. Placement

· Introduction of the proceeds of crime into the flow of commercial funds.

3. Hiding the traces

· Sending money to other accounts;

· Sending money to other countries.

4. Integration - the creation of legitimacy derived wealth

· Laundered money is returned to the criminals.

Typical and at the same time ingenious example is the intermediate company, that is the procedure by which created and funded by unrelated corporations.By such a progressive installation screens original illegality itself belongs money dimmed in the first property and completely lost in the next.

Methods of money laundering.

• The use of gambling houses;

• The use of the national banking system;

• Conclusion of fictitious leases;

• The system accounts for over-and under-import bills for export;

• «Compensation».

Let’s talk about «financial paradises».

The main directions of some of the «financial paradise»:

1. Island of Jersey, Guernsey and Sark, located in the English Channel, and are part of the United Kingdom, they are, nevertheless, enjoy the full financial and fiscal independence from the United Kingdom and other European Union countries.

2. Cayman Islands (Grand Cayman, Little Cayman and others). Former British colonies, completely free today in economic terms, have such a device by which to companies and offshore financial operations provided such benefits tax credits as tax exemption for legal persons and on income from capital, from fiscal deductions and the coupon tax, the payment of social security contributions, income tax and VAT. In addition to this exchange rate regime is absolutely labour therefore disallows islands within and beyond any amount in any currency.

3. Antilles. Although they are part of the Kingdom of the Netherlands, but enjoy full autonomy in 1954. In accordance with the agreement signed with the U.S. in 1948 and operated until 1987, firms registered in the five islands of the archipelago (Aruba, Bonaire, St. Eustace, St. Martin and Curacao), had the right not to pay taxes on individual income investments made in the USA.

4. The seat of the so-called bank-ghosts. We are talking about some of the smaller countries (Nauru Island, Vanuatu, Tonga, Antigua, Barbuda, Angilya, Marshall and Mariana Islands in the northern part of Micronesia), which have characteristics in common with the already mentioned islands - financial paradise.

Indeed, these countries do not need a guarantee that is generally required for the accreditation of the bank, such as: recognition by the host country, confirmed the possession of large share capital and checking specialized international agencies - you just make the minimum registered capital (even a few thousand dollars USA) to open the bank.

One of the most popular Russian store money is Cyprus. Planned EU support measures Cypriot banks will benefit above all account holders with “dirty" money from Russia, writes Der Spiegel[4].

Germany's Federal Intelligence Service (FIS) has produced a secret document, according to which the accounts of Cypriot banks are owned by the citizens of Russia $ 26 billion, according to the material to be released in hard copy edition of Monday, according to Deutsche Welle.

If the European Union decides to provide assistance Cypriot banks, with the help of these measures will be protected concealed from the tax authorities money Russians notes weekly.

The report FIS also states that the government of Cyprus is still present opportunities for money laundering. In addition, the rich Russians can without difficulty obtain nationality. In this way, about 80 Russian oligarchs have acquired the right of free choice of residence within the entire European Union, according to Der Spiegel, citing a report by department.

We call some methods of dealing with the "laundering" of money is graphically presented in Figure 3. For effective anti-money laundering to the interaction between the following bodies:

Figure 3. Cooperation methods to combat money laundering

In addition, the need for collaboration between private institutions, particularly banks and other financial institutions:

• To coordinate the international efforts to combat money laundering in 1989, at the summit of the «Big Seven» in Paris was established International Financial Action Group against Money-Laundering (FATF English. Financial Action Task Force on Money Laundering, FATF);

• Financial Monitoring Service, headed by Viktor Zubkov;

• A group of «Egmont» - an informal association of financial intelligence units (FIU) of the world;

• Declaration currency[5].

No one is denying the negative impact on the economy of shadow finance the country or region as a whole, but a recent Deutsche Bank experts have concluded that countries with a large spread of illegal economic activity more resistant to recession. As an example, the German banking specialists led Greece, which became famous throughout Europe for the «black market[6]».

Actual numbers, of course, no one knows, but guesses that the informal sector is sufficiently developed in the country. According MoneyTimes.ru with reference to The Financial Times, the share of illegal economic activity of GDP in Greece is 25%.

However, during the global crisis, the budget deficit and external debt of 125% of GDP, the economy's decline in 2009, marked only by 0.7%. Not far behind from Greece and another European «shadow» leader - Portugal. GDP decline in the western European country was 2.6%. While the average for the Old World marked economic decline of 4%.

After studying the history of the emergence of shadow finance problems in the country and the world in general, as well as the trend of development in the modern world, it can be concluded that with the advent of the market economy the informal sector has not disappeared, but has found new strength, and unfortunately, time is growing and taking on new forms, adapting as under the law, and under the environment in general. Therefore, the problem of the shadow economy, and in particular corruption - as a result of the global economic conditions is one of the most pressing issues at the moment, which require in-depth analysis in addition, also the development of new forms and ways of reducing the impact of this phenomenon on the economy.

Bibliography cited

1. Oleinik, A. "Institutional Economics" - M.: "Infra - M", 2000.

2. Russian Academy of Sciences www.ras.ru

3. Russian business newspaper, № 602, 05.08.2007

4. Rossiyskaya Gazeta, 15.01.2010

5. Rossiyskaya Gazeta - Federal Issue number 4223 of 16 November 2006, "10 thousand euros and no more. EU imposes a restriction on the import of cash. "

6. Tertyshny SA Eurasian international scientific and analytical magazine.

7. www.anti-corr.ru

8. www.finman.ru/articles/2007/2/4811.html

9. www.gazeta.ru/business/news/2012/11/04/n_2601401.shtml

10. www.gks.ru Rosstat RF

11. www.novayagazeta.ru / economy

12. www.wikipedia.ru

[1] Russian business newspaper № 602, «Shadow Boxing»

[2] Eurasian International Journal of Analytical Science, problems of the modern economy, N 4 (40), 2011

[3] Tertyshny SA, Eurasian international analytical scientific journal

[4] http://www.gazeta.ru/business/news/2012/11/04/n_2601401.shtml

[5] "10 thousand euros and no more. EU imposes a restriction on the import of cash "," Rossiyskaya Gazeta "- federal issue № 4223 from November 16, 2006

[6] Rossiyskaya Gazeta, January 15, 2010

2015-07-21

2015-07-21 888

888