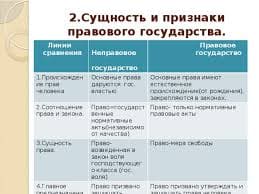

The vertical distance between points A and C represents a tax in the market.

20. Refer to Figure 8-3. The equilibrium price before the tax is imposed is

| a. | P1. |

| b. | P2. |

| c. | P3. |

| d. | P4. |

21. Refer to Figure 8-3. The price that buyers effectively pay after the tax is imposed is

| a. | P1. |

| b. | P2. |

| c. | P3. |

| d. | P4. |

22. Refer to Figure 8-3. The price that sellers effectively receive after the tax is imposed is

| a. | P1. |

| b. | P2. |

| c. | P3. |

| d. | P4. |

23. Refer to Figure 8-3. The per unit burden of the tax on buyers is

| a. | P3 - P1. |

| b. | P3 - P2. |

| c. | P2 - P1. |

| d. | P4 - P3. |

24. Refer to Figure 8-3. The per-unit burden of the tax on sellers is

| a. | P3 - P1. |

| b. | P3 - P2. |

| c. | P2 - P1. |

| d. | P4 - P3. |

25. Refer to Figure 8-3. The amount of the tax on each unit of the good is

| a. | P3 - P1. |

| b. | P3 - P2. |

| c. | P2 - P1. |

| d. | P4 - P3. |

26. Refer to Figure 8-3. The amount of tax revenue received by the government is equal to the area

| a. | P3ACP1. |

| b. | ABC. |

| c. | P2DAP3. |

| d. | P1CDP2. |

27. Refer to Figure 8-3. The amount of deadweight loss associated with the tax is equal to

| a. | P3ACP1. |

| b. | ABC. |

| c. | P2ADP3. |

| d. | P1DCP2. |

28. Refer to Figure 8-3. The loss in consumer surplus caused by the tax is measured by the area

| a. | P1P3AC. |

| b. | P3ABP2. |

| c. | P1P3ABC. |

| d. | ABC. |

29. Refer to Figure 8-3. The loss in producer surplus caused by the tax is measured by the area

| a. | ABC. |

| b. | P1P3ABC. |

| c. | P1P2BC. |

| d. | P1C0. |

30. Refer to Figure 8-3. Which of the following equations is valid for the tax revenue that the tax provides to the government?

| a. | Tax revenue = (P2 - P1)xQ1 |

| b. | Tax revenue = (P3 - P1)xQ1 |

| c. | Tax revenue = (P3 - P2)xQ1 |

| d. | Tax revenue = (P3 - P1)x(Q2 - Q1) |

31. Refer to Figure 8-3. Which of the following equations is valid for the deadweight loss of the tax?

| a. | Deadweight loss = (1/2)(P2 - P1)(Q2 + Q1) |

| b. | Deadweight loss = (1/2)(P3 - P1)(Q2 + Q1) |

| c. | Deadweight loss = (1/2)(P3 - P2)(Q2 - Q1) |

| d. | Deadweight loss = (1/2)(P3 - P1)(Q2 - Q1) |

2015-08-13

2015-08-13 929

929