The anticipated rate of inflation is reported by the U.S. Federal Reserve to Congress regularly and includes estimates for a minimum three-year period. Most anticipatory interest rates are reported as ranges instead of single point estimates. As the true rate of inflation may not be known until the time period corresponding with the holding time of the investment has passed, the associated real interest rates must be considered predictive, or anticipatory, in nature when the rates apply to time periods that have yet to pass.

Effect of Inflation Rates on the Purchasing Power of Investment Gains

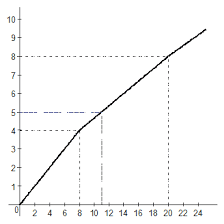

In cases where inflation is positive, the real interest rate is lower than the advertised nominal interest rate. For example, if funds used to purchase a certificate of deposit (CD) are set to earn 4% in interest per year and the rate of inflation for the same time period is 3% per year, the real interest rate received on the investment is 4% - 3% = 1%. The real value of the funds deposited in the CD will only increase by 1% per year, when purchasing power is taken into consideration.

If those funds were instead placed in a savings account with an interest rate of 1%, and the rate of inflation remained at 3%, the real value, or purchasing power, of the funds in savings will have actually decreased, as the real interest rate would be -2%, after accounting for inflation.

Nominal means very small or far below the real value or cost, and in finance, this adjective modifies words such as fee, interest rate and gross domestic product (GDP). A nominal fee simply refers to a fee that is below the cost of the service provided or presumably easy for a consumer to afford. When describing concepts such as interest rate or GDP, nominal refers to their unadjusted rate, value or current pricewithout taking elements such as inflation, seasonality, loan fees, interest compounding or other factors into account.

BREAKING DOWN 'Nominal'

In contrast to nominal, real expresses the value of something after making adjustments for various factors to create a more accurate measure. For example, the difference between nominal and real GDP is that nominal GDP measures the economic output of a country using current market prices, and real GDP takes inflation into account to create a more accurate measure.

Nominal vs. Real Rate of Return

The rate of return is the amount an investor earns on an investment. While the nominal rate of return reflects the investor's earnings as a percentage of his initial investment, the real rate takes inflation into account. As a result, the real rate gives a more accurate assessment of the actual buying power of the investor's earnings.

What is rental rate? What is the difference between differential rate I anad II?

The upcoming discussion will help you to differentiate between differential rent and scarcity rent.

1. Rent as stated by Ricardo is a differential surplus in the sense that a more fertile or super marginal land earns a surplus of revenue over its costs.

It is a surplus over the earnings of marginal land, since marginal land earns a revenue just to cover its costs. So, it earns no rent, because rent is a surplus over the cost. But modern economists are of this opinion that rent is a differential surplus in the sense of a difference between the actual earnings and transfer earnings of a factor of production.

ADVERTISEMENTS:

2. Next, it has been said that any factor which earns such a differential surplus i.e., rent, so long as its supply is less than perfectly elastic. But Ricardo has said that a more fertile land earned a differential rent because of its greater productivity. The concept of scarcity rent, however implies that rent of land arises on account of scarcity. But Ricardo did not consider the thought of scarcity.

3. Modern economists, considers that since the supply of land is fixed, irrespective of its fertility, there is a scarcity of land. Therefore, rent tends to rise with the increase in demand.In short, it can be said that scarcity rent is demand determined.

Ricardo, on the other-hand, attributes rent only to land as a factor of production. Modern economists, however, take a broader view and regard that rent can be earned by any factor of production (and not confined to land alone), so long as its supply is less than perfectly elastic i.e., scarcity of the factor remains.

4. Land earns differential rent, or scarcity rent for ever, as the differences in the fertility or scarcity are permanent, while the other factors can only be temporary as their scarcity is only temporary.

ADVERTISEMENTS:

Distinction between the Ricardian Theory of Rent and the Modern Theory of Rent:

Important difference between the Ricardian Theory of Rent and the Modern Theory of Rent are as follows:

1. Ricardian theory of rent is the return for the original and indestructible powers of the soil. But the modern theory of rent is surplus earned by any factor of production not necessarily land, over and above the minimum earnings necessary to induce it to do its work.

2. In Ricardian theory, rent is due to differences in fertility and situation. While in modern theory it is due to scarcity or specificity.

3. In Ricardian theory, Rent is a surplus above the marginal or no rent-land. While in modern theory it is the difference of actual earnings and transfer earnings.

4. Ricardo says—”Rent does not enter into Price” while modern economists are of this opinion that rent enter into price.”

5. In Ricardian theory, production of land is the important basis of determination of rent while in modern theory power of demand and supply plays an important role.

6. Ricardo theory is based on various assumptions while modern theory is not based on any assumptions.

2018-02-13

2018-02-13 606

606