Some of the most common banks are listed below, but the dividing lines are not always clean cut. Some banks work in multiple areas (for example, a bank might offer personal accounts, business accounts, and even help large enterprises raise money in the financial markets).

· Retail banks are probably the banks you’re most familiar with: Your checking and savings accounts are held at a retail bank, which focuses on consumers as customers. These banks give you credit cards, offer loans, and they’re the ones with numerous branch locations in populated areas.

· Commercial banks focus on business customers. Businesses need checking and savings accounts just like individuals do. But they also need more complex services, and the dollar amounts can be much larger. They might need to accept payments from customers, rely heavily on lines of credit to manage cash flow, and they might use letters of credit to do business overseas.

· Investment banks help businesses work in financial markets. If a business wants to go public or sell debt to investors, they’ll often use an investment bank.

· Central banks manage the monetary system for a government. For example, the Federal Reserve Bank is the US central bank responsible for managing economic activity and supervising banks.

· Credit unions are similar to banks, but they are not-for-profit organizations owned by their customers (most banks are owned by investors). Credit unions offer products and services more or less identical to most retail and commercial banks. The main difference is that credit union members share some characteristic in common.

· Online banks operate entirely online – there are no physical branch locations available to visit with a teller or personal banker. Many brick-and-mortar banks also offer online services, such as the ability to view accounts and pay bills online, but internet-only banks are different: they often offer competitive rates on savings accounts and they’re especially likely to offer free checking.

· Mutual banks are similar to credit unions because they are owned by members (or customers) instead of outside investors.

· Savings and loans are less prevalent than they used to be, but they are still important. This type of bank was important in making home ownership mainstream, using deposits from customers to fund home loans. The name savings and loan refers to the core activity they perform: take savings from one customer and make loans to another.

What is commercial credit and why does enterprise use it?

Commercial credit is a credit granted by a bank to a business concern to finance commercial transaction.Commercial credit is often used by companies to help fund new business opportunities or to pay for unexpected charges. For example, imagine that XYZ Manufacturing Inc. has the chance to buy a piece of much needed machinery at a deep discount. Let's assume that the piece of equipment normally costs $250,000, but is being sold for $100,000 on a first-come, first-serve basis. In this example, XYZ Manufacturing could access its commercial credit agreement to get the required funds immediately. The firm would then pay the borrowed amount back at a later date.

What is more popular form of credit in Kazakhstan? Why?

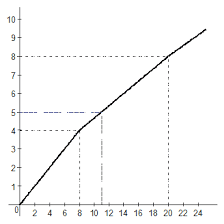

One of the main functions of banks is lending to the economy. Bank credit is the most common form of credit relations in the economy. Currently, the main risk factors for banks associated with lending to the population are general economic shocks that could lead to a decrease in the solvency of the population, a decline in property prices and the instability of exchange rates. As for the corporate sector, the risks here are primarily due to the high proportion of loans directed to the economy, whose businesses, in the event of a decline in business activity, are more mobile, which could lead to increased bankruptcies and a deterioration in the quality of the loan portfolio. Because a slowdown in the growth of the economy may lead to a decrease in the ability of borrowers to repay loans, it is necessary for banks to reorient lending from the branches of trade and real estate in the manufacturing, transport, and agricultural industries.The market rate of loan interest is determined by the interaction of supply and demand in the credit market. With a high interest rate, the capital productivity of the enterprise is relatively low, the demand decreases accordingly, and the loan offer increases. When the interest rate decreases, the profitability for the enterprise grows, it makes sense to borrow money. And the population makes a choice in favor of using a loan in order to meet their needs at the expense of borrowed funds. A decrease in interest rates on loans leads to an increase in demand for credit. In this connection, the process of changing interest rates on loans will be constantly on the move.

Explain the influence of income the demand for goods and services

The demand for a good or service represents the willingness and ability of buyers or consumers to purchase goods and services. The total demand for a product will depend on a number of factors with the most obvious factor being the price of the product. A rational consumer will seek to purchase products at the lowest price possible because it maximizes the value or satisfaction he or she gets from purchasing and consuming the product

Almost without exception, when the price of a product falls, the total demand for the product will rise in response.

Existing consumers may increase the amount they purchase given that their income “will go further” and be able to afford a greater volume of that particular product. In economics we sometimes refer to this as the income effect

2018-02-13

2018-02-13 1126

1126