1. What are capital gains and losses?

2. When is Capital Gains Tax activated?

3. How is Capital Gains Tax calculated?

4. How can the liability for Capital Gains Tax be reduced?

5. What happens when a company’s capital losses exceed its capital gains of the same year?

Exercise 2. Find a word in the text that matches each definition below. The words appear in order.

1. (three words) A sale of an asset or any other transfer of ownership ______

2. (two words) A long-term asset, such as land, building, equipment, used to produce income for a company ________________

3. (two words) Profit realized from the disposal of a capital asset for a price that is higher than the purchase price ________________

4. Part of a company’s value that includes things that cannot be directly measured, for example, its good reputation or its customers’ loyalty ________________

5. (two words) An expense incurred for the purpose of enhancing the value of an asset ________________

6. To activate ________________

7. To gain or increase in value ________________

8. (two words) Responsible for paying something ________________

9. To balance one effect against an opposing effect ________________

10. (two words) To move to a later accounting period ________________

GRAMMAR FOCUS:

Present Perfect Continuous

Exercise 3.

You are a head of a Tax Accounting Department. Your superiors think that your employees are not efficient enough and take too much time doing their jobs. You are interviewing each member of your staff to find out how much time they have spent today for each individual task. Use the prompts below, as well as your own ideas, to ask questions.

prepare a tax return analyse financial statements

advise clients on company formation issues write a tax due diligence report

negotiate an engagement with a client have lunch with a client

Example: How long have you been writing the tax due diligence report?

Report the information to the class.

Exercise 4. Text completion.

Read the text and complete it with the following words.

Property Tax Tariff

trade barrier Excise Tax or Excise Duty

Stamp Duty Land Tax Customs Duty

Local and Municipal Taxes Inheritance Tax

Other Forms of Taxation

In addition to the taxes discussed previously, companies or individuals may also be subject to the following levies:

____________ (1)

A tax charged by customs authorities on merchandise imported from one country to another. Customs duty is levied to raise state revenue and protect domestic industries from competitors from abroad.

____________ (2)

An indirect tax charged on the sale of specific goods, such as petrol, tobacco products or alcohol. One of the reasons for imposing excise duties is to discourage consumption of the good that is being taxed. In addition, excise duties represent a significant source of income for the state.

____________ (3)

A tax imposed on imported goods and services. Tariffs act as a form of_________ (4) used to restrict trade, as they increase the price of imported goods and services, making them more expensive to consumers.

____________ (5)

A tax levied on property by a local government, based on an estimated value of property.

_____________ (6) (US: Transfer Tax)

A tax levied by the state on purchase of houses, flats, land and buildings.

_____________ (7)

A type of a tax that is imposed on individuals who inherit assets from a deceased person.

_____________(8) (UK: Council Tax)

Taxes imposed by local governments (municipalities) to fund local government services.

Exercise 5. Match the words to their meaning:

| 1.core activity | A.to acquire, usually something negative; for example losses, costs, liability, expense |

| 2.disposal | B.along-term asset, such as land or a building, not purchased or sold in the normal course of business |

| 3.capital asset | C.to increase in value |

| 4.capital gain | D.the basic and most important activity |

| 5.inventory | E.shares, bonds, options, etc. |

| 6.securities | F.an intangible asset that arises when one company acquires another, but pays more than the fair market value of the net assets |

| 7.to appreciate | G.finished products, as well as the raw materials used to make the products |

| 8.goodwill | H.to cancel each other out |

| 9.to incur | I.a sale |

| 10.to offset | J.profit realized from the sale of a capital asset |

SPEAKING FOCUS

Exercise 6.

A) Which of the opinions below do you agree with? Explain why.

A. Capital Gains Tax should be lower because:

High Capital Gains Tax slows down a country’s economic activity. This encourages owners of assets not to sell, due to negative tax implications of selling.

B. Capital Gains Tax should be higher because:

Most capital gains are not derived from genuine capital investments, but rather from gains earned through speculative investments in stock’s value.

b) In your opinion, is Excise Duty an effective method of limiting the consumption of certain products?

Exercise 7.

Accounting Terms

Understanding taxation matters requires a thorough knowledge of financial and accounting terminology. A selection of accounting terms is presented in the exercise below. Match the words to their definitions:

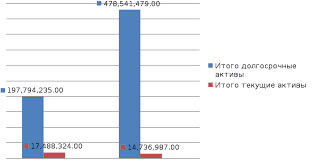

1. JP Morgan is the largest US bank with the (the total amount of all items of economic value owned by a company) of US$ 2.6 trillion.

2. The net worth of a company is measured by subtracting a company’s (the total amount of all financial obligations of a company) from its total assets.

3. Net worth of a company is also referred to as its (total assets minus total liabilities).

4. (assets which are easily converted into cash within one year) typically include items such as cash, marketable securities, accounts receivable, stock inventory, short-term investments, etc.

5. Examples of items recorded as (a company’s debts or obligations that are due within one year) typically include accounts payable, accrued expenses, interest expense, short-term debts, salaries and wages, income tax payable, etc.

6. (assets that are not expected to become cash within one year) are also known as non-current assets.

7. (assets that are purchased for long-term use and not likely to be converted quickly into cash) are one of several categories of non-current assets, usually reported on balance sheet as property, plant and equipment.

8. Examples of items recorded as (a debt due after a year) typically include long-term loans, deferred taxes, notes payable maturing after a year, etc.

9. (money that a company owes to suppliers) is a current liability account that shows the amount a company owes for goods or services purchased on credit.

10. (money owed to a company by its debtors) is a current asset account that shows the sales made but not paid for by the customers.

| current assets | accounts payable | total liabilities | accounts receivable |

| fixed assets | current liabilities | net assets | long-term assets |

| total assets | long-term liabilities | ||

Exercise 8.

a) Work with a partner. You are a financial journalist and he or she is an owner of a successful company. Use the expressions from the exercise above to interview him or her and assess his or her financial situation.

b) Describing how Capital Gains Tax is calculated and charged in your country.

VOCABULARY FOCUS

adopt a resolution (v) вынести решение

allocation размещение; распределение; отчисление

ambiguity неясность, двусмысленность

amend (v) вносить дополнения, изменения

amendments (pl) изменения и дополнения

apply for (v) обращаться за; подавать заявление

appreciate (v) увеличивать стоимость

be obligated to быть обязанным

be subject to подлежать; подпадать под действие

capital asset основные средства

capital gains доходы от прироста капитала

carriage перевозка

carry forward (v) делать перенос на будущий период

charge (v) взимать

circulation of commodities товарное обращение

combustive горючий; воспламеняемый

commence (v) начать; приступить

comply (v) исполнять; подчиняться; следовать

consideration расчет

construction and installation works строительно-монтажные работы

corporate profit tax налог на прибыль организаций

cost- benefit затраты и результаты; рентабельность

customs duty таможенный сбор

customs procedure таможенная процедура

customs value таможенная стоимость

deem (v) полагать, думать, считать

digital products (pl) цифровые товары

disposal of assets реализация (распродажа) активов

engage (v) заниматься; участвовать

enhancement expenditure увеличение расходов

establishment становление; учреждение

excise duty акцизный налог

exempt from (v) освобождать от

expenses incurred понесенные издержки

foodstuff продукты питания

foundation организация

free-of-charge бесплатный; на безвозмездной основе

freight-forwarding services транспортно-экспедиционные услуги

goodwill деловая репутация организации

HMRC (Her Majesty’s Revenue and Министерство (Ее Величества) по

Customs) налогам и таможенным сборам

Inheritance tax налог с наследства

input VAT входящий НДС

in compliance with в соответствии с (чем-л.)

in respect of в отношении; применительно к

international transportation services услуги международных перевозок

leasing of premises аренда помещений

legal entity юридическое лицо

lubricating material смазочный материал

minor второстепенный

non-deductible не подлежащие вычету

offset (v) компенсировать

periodical printed publication периодическое печатное издание

property rights права собственности

property tax налог на собственность

provision положение (договора, закона и т.д.); предоставление

railway vehicles (pl.) железнодорожный транспорт

reference to ссылка на; привязка к

regardless независимо от

render (v) оказывать; исполнять

representative office представительство (компании)

sales tax налог с продаж

stamp duty гербовый сбор

submit (v) представлять на рассмотрение

Supreme Arbitration Court Высший Арбитражный Суд

tax threshold нижние границы налогообложения

tax legislation налоговое законодательство

trade barrier торговый барьер

VAT exempt необлагаемый НДС; освобожденный от НДС

VAT legislation налоговое регулирование НДС

VAT register реестр НДС

VAT returns налоговая декларация по НДС

VAT treatment режим взимания НДС

volume объем, величина

warranty repair гарантийный ремонт

PART 3

2020-09-24

2020-09-24 394

394