Auditors usually seek evidence from less than 100% of items of the balance or transaction being tested by using sampling techniques.

Audit sampling is the application of audit procedures to less than 100% of items within a population of audit relevance such that all sampling units have a chance of selection. This will enable the auditor to obtain and evaluate audit evidence about some characteristic of the items selected in order to provide the auditor with a reasonable basis on which to draw conclusions about the entire population. Audit sampling can be applied using either statistical or non-statistical approaches.

The population is the entire set of data from which a sample is selected and about which the auditor wishes to draw conclusions.

Auditors do not normally examine all the information available to them as it would be impractical to do so and using audit sampling will produce valid conclusions. ISA 530 Audit sampling provides guidance to auditors.

Some testing procedures do not involve sampling, such as:

· Testing 100% of items in a population

· Testing all items with a certain characteristic as selection is not representative

Auditors are unlikely to test 100% of items when carrying out tests of controls, but 100% testing may be appropriate for certain substantive procedures. For example, if the population is made up of a small number of high value items, there is a high risk of material misstatement and other means do not provide sufficient appropriate audit evidence, then 100% examination may be appropriate.

Audit sampling can be done using either statistical sampling or non-statistical sampling methods.

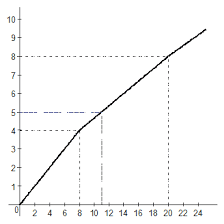

Statistical sampling is an approach to sampling that involves random selection of the sample items, and the use of probability theory to evaluate sample results, including measurement of sampling risk.

|

|

|

Non-statistical sampling is a sampling approach that does not have these characteristics.

So, bearing in mind the definitions above, sampling is non-statistical when it does not meet the criteria required of statistical sampling. If each item of the population does not have an equal chance of selection, the sampling technique is non-statistical.

The difference between the two types of sampling is that, with statistical sampling, the sampling risk can be measured and controlled (we look at sampling risk in Section 3.2). With non-statistical sampling it cannot be measured.

Although the audit procedures performed on the items in the sample will be the same, whether a statistical or non-statistical approach is used, meaningful extrapolation can only occur from a statistical sample which has been selected randomly.

The auditor may alternatively select certain items from a population because of specific characteristics they possess. The results of items selected in this non-statistical way cannot be projected onto the whole population but may be used in conjunction with other audit evidence concerning the rest of the population.

· High value or key items. The auditor may select high value items or items that are suspicious, unusual or prone to error.

· All items over a certain amount. Selecting items this way may mean a large proportion of the population can be verified by testing a few items.

· Items to obtain information about the client's business, the nature of transactions, or the client's accounting and control systems.

· Items to test procedures, to see whether particular procedures are being performed

2017-11-30

2017-11-30 220

220