-1-

The factor markets allocate the factors of production among the various producers/sellers. In a market economy, the inputs [land (R), labour (L), capital (K) and entrepreneurial ability] are owned by individual agents who make decisions about the amount of each input they want to supply. The decisions of the producers determine the demand for the inputs.

Remember that the decisions of the producers reflects the preferences and ability In the goods markets, each individual consumer will maximize their utility when: MUx / PX = MUY / PY

This is an equilibrium condition. The consumer cannot alter their expenditure and improve their welfare or increase their utility. Income (budget), preferences (MUN) and the relative prices determine the outcomes. The market demand reflects these conditions to the market. The demand function is a schedule of the maximum price (reservation price) that buyers are willing and able to pay for a schedule of quantities of a good in a given period of time (ut), ceteris paribus. The supply function in the market reflects the opportunity cost or producing each unit of output. It can be defined as the minimum price (reservation price) that the seller will accept for each unit of output. Market equilibrium is determined by the interaction of the buyers and sellers.

The equilibrium of the buyers and market equilibrium depends on the income of the buyers. The way in which income is distributed in a system determines the allocation decisions. The judgment about the criteria used to distribute income has both an ethical and efficiency dimension. In most social groups, it is considered desirable that income be distributed in proportion to the contributions to the achievement of objectives. Clearly, most societies make exceptions; most societies refuse to let individuals who are incapable of making contributions do without resources and goods to support life. In industrial societies there is a range of judgments regarding what things should be provided. At one extreme few resources are provided.

At the other extreme a higher level of comfort is considered appropriate. From an efficiency perspective, each factor should receive a share of income in proportion to the factor’s contribution to the value of the output. John Bates Clark (1847-1938) was one of the architects of the “marginal productivity theory of income distribution.” In concept the idea is simple, in practice it is difficult to measure the contributions of each factor to the production process.

The production process was described by a production function. In its simplistic form it is: Q = f(labour, kaptial, land, technology,...) The marginal product of each factor describes the contribution of each factor to the production of the output. The marginal product of a factor can be described as:, the change in output (Q) "caused" by a change in F (the factor).

With the use of calculus the marginal products of a set of inputs can be described as partial derivatives. Given a production function: Q = AL α K β.

If the marginal products are known and the relative prices of goods in the markets reflect the values of the outputs, the value of each factors contribution can be calculated as the product of MPF and the price of the output. The marginal productivity theory of income distribution suggests that the income share each factor of production should receive is determined by the marginal product of the input and the price of the output. The change in the value of the output associated with a change in an input is called the value of marginal product (VMP) or the marginal revenue product (MRP). Originally the VMP was used to describe the demand for an input into production process for a purely competitive firm and the MRP was used to describe the demand for an input used to produce a product where market power (a negatively sloped product demand) existed. Most texts currently use MRP as a generic term that covers both VMP and MRP.

-2-

The demand for a factor of production is a derived demand. You do not have a direct demand for an auto mechanic; rather you have a demand for an automobile that functions properly. The demand for the mechanic is a derived demand. You probably do not have a demand for 2X4’s (they really aren’t 2” by 4”), you have a demand for a house that is constructed with the lumber. The demand for an input is determined by the relative value of the good produced and the productivity of the input.

The demand for an input can be derived by using the production function (the MP for an input) and the price of the good.

The MRP is the maximum the employer will pay each unit of labour in a given period of time given the productivity (MP) and the price of the output (PX). At a wage of WR, the firm will hire N workers. All N workers are paid the same wage rate; i.e. there is no price discrimination.

The wage bill or expense is shown as area 0NRWR, measure by NWR. the producer surplus is area WRRA. The producer surplus is not the same as profit. The payment to the fixed factor must be subtracted from the producer surplus to calculate profit.

W D S

W D S

W1

W1

E

E

W*

W2 S D

W2 S D

0 L* L

-3-

The individual agent who owns the input will decide how much of a factor theywant to offer for sale at each price offered for the input. A worker must decidehow many units of labour (hours, days, weeks, years, etc) they will offer forsale at each possible wage rate. The supply of labour is a function of the wagerate, the value of leisure, alternatives available, taxes and other circumstances.

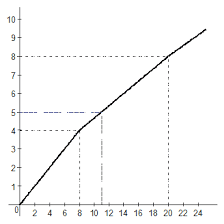

Generally it is believed that more labour will be offered for sale at higher wagerates, up to a point. Owners of other factors of production (land, capital,entrepreneurial ability)make decisions thatdetermine the supply functions of those factors.Figure illustratesseveral possible supplyfunctions. The segment HGBis one possibility, itrepresents a supply wherethe worker is willing to offermore labour at higher wagerates. The maximum labourthat will be offered for saleis at point B. At a wagerates higher than WH, thesupplier substitutes leisurefor income and offers lesslabour for sale as the wageincreases. Anotherpossibility is a supply oflabour that is represented by segment WRGB. A horizontal segment at the prevailing wage rate is caused by a worker or workers who refuse to work at any wage that is less than the prevailing wage, WR.

-4-

The market for an input includes all potential buyers and sellers of an input. The demand reflects the decisions of the buyers of the inputs and is based on the MRP for the factor. The supply function represents the decisions of the factor owners to supply the input at various prices. Figure represents a market for labour. MRP represents the demand and S is the supply of L. The market equilibrium occurs at point G where the quantity of labour offered for sale is equal to the quantity of labour that is demanded at a the wage rate WR. J units of labour are hired. An increase in the productivity of labour or the price of the good produced (PX) will increase the demand (MRP). A decrease in productivity or PX will shift the MRP to the left (MRP1). If worker are unwilling to work for less than the market wage, WR, the supply is represented by line WRGB. The level of employment would fall to F units of labour. If HGB were the relevant supply, unemployment would fall to T units and the wage would fall to WL. If the MRP increased so the wage rate exceeded WH, workers would supply a smaller quantity of labour in a given period of time.

2015-08-12

2015-08-12 662

662