substitute for oil. Cartels influence historically has been transitory, if effective at all. OPEC is one of the few cartels that has succeeded for any length of time. Cartels in aluminum, copper, coffee, an other commodities failed. The key to success (or failure) is the number and discipline of the members.

Part (a) of Figure 3.15 illustrates the problems facing cartels, as consumers shift to energy efficient equipment, like cars, furnaces, etc. as the result of high prices. Demand falls to D2, given the same supply, forcing producing countries to decide which countries must reduce production. OPEC, beginning in 1982, faced internal fights to allocate production cuts among its members and, needless to say, some countries overran their quotas constantly. The future of cartels diminishes when members place their selfish interests) - short-run needs for cash - ahead of the cartels interest.

Many other factors interact to influence supply and demand. One general topic area, which impacts investment estimates, is inflation in the general economy. Earlier inflations impact on the cost of capital, whether nominal or inflation adjusted standard was determined. The following discussion addresses various concepts of inflation and its determinants.

Inflation

Perhaps more than any other input into an evaluation, inflation is used by everyone and understood by few. Part of the misunderstanding arises from disagreements over the cause of inflation and the proper measure to use in evaluations. Defined simply, inflation measures changes in the general price level. Only when many product prices increase together does inflation exist. Annual rates of inflation have exceeded 15% in North America and Europe and 100% in parts of South America and Africa.

Inflation robs people of the ability to consume, which is

the reason most governments make an effort to control it. For example, a couple earning an income of 20 000 a year spends 2000 on food and 5000 on housing. At an inflation rate of 10%, the amount spent must rise by 700 (= 0.10 x 7000) per year in order to consume the same quantity of food and housing. If income remains constant, consumers must reduce consumption in other areas to consume the same amount of food and housing.

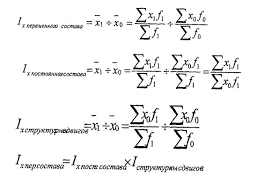

All measures of inflation are weighted averages of specific products; some measures weight them equally, while others base the weights on the relative importance of the item in the economy. For example, averaging a food price increase of 5% and a housing price rise of 15% gives an average inflation rate of 10% = (15 + 5)/2. This understates the true impact of inflation. The consumer actually pays (2000X0.05) plus (5000)(0.15), or 850 more than a year ago, not the (7000)(0.10) or 700 indicated by the average inflation rate. The downward bias occurs because housing (which has the higher inflation rate) has a greater share of the budget. Average inflation rates overstate the true inflation rate when the larger components of the budget have a higher inflation rate.

Most countries and international organizations use weighted inflation rates to correct the above problem. In this simple example, each item is weighted by its relative importance in the budget (2000/7000X0.05) + (5000/7000)(0.15) = 0.014 + 0.107 = 0.121. The 12.1% inflation rate times 7000 equals about 848, or very nearly the 850 computed above.

The weighted inflation rate impacts many government policies. Wages and benefits, for instance, are indexed to increase at the rate of inflation. Families that spend their budget in exactly the same manner as the weighting scheme break even when their wages rise with inflation. Suppose, however, that a family consumes relatively more food than housing with the same budget. A family spending 3000 on food and 4000 on housing has an actual inflation rate of (3000/7000) (0.05) + (4000/7000X0.15) = 0.021 + 0.086 = 0.107. Their costs rise 0.107 times 7000, or roughly 749. Yet indexing causes an 850 increase, a net gain to the family of over 100. If food was relatively less important, the bias would be in the other direction. Inflation indexes thus measure the impact on the total society and are not good estimates of the distribution of inflation's impact on various segments of society. Policies based on inflation, like indexing, help some members of society and hurt others.

2015-09-06

2015-09-06 259

259