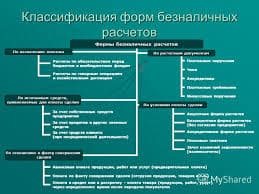

Check or cheque, bill of exchange drawn upon a bank or trust company or broker connected with a clearinghouse. Upon presentation of a check, the bank or other drawee pays cash to the bearer or to a specified person. Payment is made from those funds of the maker or drawer that are in a primary demand deposit account (checking account) with the drawee.

The check is intended for prompt presentation, rather than for use as a continuing currency. When the check is presented, the drawee pays the designated sum to the holder and cancels the check, which is then returned to the drawer as his receipt. To prevent fraud, checks are usually of tinted paper and are filled in with ink; the figures may be punched out of the paper or embossed.

Many checks also have identifying code numbers that have been printed with magnetically active ink. The numbers enable banks to clear checks mechanically and thereby speed up operations. Whether or not the check will be paid by the bank depends upon its recognition of the drawer's signature and upon the bank's confidence in the person presenting the check for payment. A bank becomes primarily liable for payment only when it "certifies" on a check that the necessary funds are in the bank to the credit of the drawer.

However, a bank is usually responsible to its depositor for paying forged checks. All local checks accepted by a bank are turned over daily to a clearinghouse, which cancels checks due from and to all banks of a given neighborhood, the balances alone being paid in cash. Banks settle out-of-town checking claims by means of entries made in the books of the appropriate Federal Reserve banks.

TEXT 4

2015-10-13

2015-10-13 480

480