Pricing Objectives have to be consistent with an organization’s overall marketing objectives

Examples of Pricing Objectives:

-Maximization of profits

-Enhancing product or brand image

-Providing customer value

-Obtaining an adequate return on investment or cash flow

-Maintaining price stability

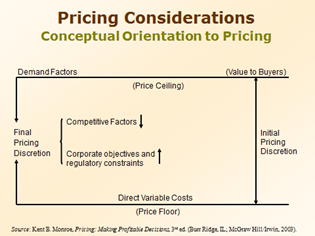

-Demand sets the price ceiling

-Direct (variable) costs set the price floor

Campbell Soup’s Intelligent Quisine (IQ) line

*Consumers found the products too expensive

*Lower price could not cover variable costs

Factors narrowing pricing discretion

*Government regulations

*Price of competitive offerings

*Organizational objectives and policies

Other factors affecting the pricing decision

*Life-cycle stage of product or service

*Effect of pricing decisions on profit margins of marketing channel members

*Prices of other products and services provided by the organization

Price as an Indicator of Value

*Value can be defined as the ratio of perceived benefits to price:

Value = perceived benefits

price

*Price affects perception of quality.

*Price affects consumer perceptions of prestige. Example:

Swiss watchmaker TAG Heuer

Raised average price of its watches from $250 to $1000

Sales volume increased sevenfold!

*Consumer value assessments are often comparative – worth and desirability of a product relative to substitutes that satisfy the same need (e.g., Equal vs. sugar)

*Consumer’s comparison of costs and benefits of substitute items gives rise to a “reference value”

Price Elasticity of Demand

Price Elasticity of Demand is a concept used to characterize the nature of the price-quantity relationship

Price Elasticity of Demand is a concept used to characterize the nature of the price-quantity relationship

The coefficient of price elasticity, E, is a measure of the relative responsiveness of the quantity of a product demanded to a change in the price of that product

The coefficient of price elasticity, E, is a measure of the relative responsiveness of the quantity of a product demanded to a change in the price of that product

If the percentage change in quantity demanded is greater than the percentage change in price, i.e., E >1, then demand is said to be elastic.

If the percentage change in quantity demanded is greater than the percentage change in price, i.e., E >1, then demand is said to be elastic.

If the percentage change in quantity demanded is less than the percentage change in price, i.e., E <1, then demand is said to be inelastic.

If the percentage change in quantity demanded is less than the percentage change in price, i.e., E <1, then demand is said to be inelastic.

Factors affecting Elasticity of Demand

*The more substitutes the product or service has, the greater the elasticity

*The more uses a product or service has, the greater the elasticity

*The higher the ratio of the price of the product or service to the income of the buyer, the greater the elasticity

Product-Line Pricing

Cross-Elasticity of Demand relates the price elasticity simultaneously to more than one product or service

Cross-Elasticity of Demand relates the price elasticity simultaneously to more than one product or service

The Cross-Elasticity Coefficient is the ratio of the change in quantity demanded of product A to a price change in product B

The Cross-Elasticity Coefficient is the ratio of the change in quantity demanded of product A to a price change in product B

A negative coefficient indicates the products are complementary (camera and film); a positive coefficient indicates they are substitutes (apple and pear)

A negative coefficient indicates the products are complementary (camera and film); a positive coefficient indicates they are substitutes (apple and pear)

Product-line pricing involves determining:

1. the lowest-priced product and price

plays the role of traffic builder

plays the role of traffic builder

2. the highest-priced product and price

positioned as the premium item

positioned as the premium item

3. price differentials for all other products in the line

reflect differences in their perceived value of the products offered

reflect differences in their perceived value of the products offered

Estimating the Profit Impact from Price Changes

Impact of price changes on profit can be determined from:

Cost data

Cost data

Price data

Price data

Volume data for individual products and services

Volume data for individual products and services

Unit volume necessary to break even on a price change is:

Pricing Strategies

A business can use a variety of pricing strategies when selling a product or service. The price can be set to maximize profitability for each unit sold or from the market overall. It can be used to defend an existing market from new entrants, to increase market share within a market or to enter a new market. Businesses may benefit from lowering or raising prices, depending on the needs and behaviors of customers and clients in the particular market. Finding the right pricing strategy is an important element in running a successful business.

Markup Pricing

Selling price is determined by adding a fixed amount, usually a percentage, to the (total) cost of the product

Selling price is determined by adding a fixed amount, usually a percentage, to the (total) cost of the product

Most commonly used pricing method (e.g., groceries and clothing)

Most commonly used pricing method (e.g., groceries and clothing)

Simple, flexible, controllable

Simple, flexible, controllable

Example: If a product costs $4.60 to produce and selling price is $6.35, the market on cost is 38% and markup on price is 28%.

Example: If a product costs $4.60 to produce and selling price is $6.35, the market on cost is 38% and markup on price is 28%.

Breakeven Pricing

Equals the per-unit fixed costs plus the per-unit variable costs

Equals the per-unit fixed costs plus the per-unit variable costs

Useful tool for determining the minimum price at which a product must be sold to cover fixed and variable costs

Useful tool for determining the minimum price at which a product must be sold to cover fixed and variable costs

Often used by non-profit organizations, or by profit-making organizations that may have a short-term breakeven objective

Often used by non-profit organizations, or by profit-making organizations that may have a short-term breakeven objective

Rate-of-Return Pricing

Price is set so as to obtain a pre-specified rate of return on investment (capital) for the organization

Price is set so as to obtain a pre-specified rate of return on investment (capital) for the organization

Assumes a linear demand function and insensitivity of buyers to price

Assumes a linear demand function and insensitivity of buyers to price

Most commonly used by large firms and public utilities whose return rates are closely watched or regulated by government agencies or commissions

Most commonly used by large firms and public utilities whose return rates are closely watched or regulated by government agencies or commissions

Variable-Cost Pricing

Represents the minimum selling price at which the product or service can be marketed in the short run. It is often used to:

Stimulate demand (lower fares for seniors)

Stimulate demand (lower fares for seniors)

Can increase revenues, and hence, lead to economies of scale, lower unit costs, and higher profits

Shift demand (weeknight calling plans)

Shift demand (weeknight calling plans)

Away from peak load times to smooth it out over extended time periods New-Offering Pricing Strategies

1. Skimming Pricing Strategy (Gillette Mach3)

price initially set very high and reduced over time

price initially set very high and reduced over time

2. Penetration Pricing Strategy (Nintendo)

price is initially set low to gain a foothold in the market

price is initially set low to gain a foothold in the market

3. Intermediate Pricing Strategy

between the two extremes; most prevalent

between the two extremes; most prevalent

When to Use Skimming Pricing

Appropriate when:

1. Demand is likely to be price inelastic

2. There are different price-market segments

3. The offering is unique enough to be protected from competition by patent, copyright, or trade secret

4. Production or marketing costs are unknown

5. A capacity constraint in producing the product or providing the service exists

6. An organization wants to generate funds quickly

7. There is a realistic perceived value in the product or service

When to Use Penetration Pricing

Appropriate when:

1. Demand is likely to be price elastic

2. The offering is not unique or protected by patents, copyrights, or trade secrets

3. Competitors are expected to enter market quickly

4. There are no distinct and separate price-market segments

5. There is a possibility of large savings in production and marketing costs if a large sales volume can be generated

6. The organization’s major objective is to obtain a large market share

Pricing and Competitive Interaction

Competitive Interaction refers to the sequential action and reaction of rival companies in setting and changing prices for their offering(s) and assessing likely outcomes, such as sales, unit volume, and profit for each company and an entire market.

Advice for managers to avoid nearsightedness of not looking beyond the initial pricing decision:

1. Managers are advised to focus less on short-term outcomes and attend more to longer-term consequences of actions

2. Managers are advised to step into the shoes of rival managers or companies and answer a number of questions…

Pricing and Competitive Interaction

1. What are competitors’ goals and objectives? How are they different from our goals and objectives?

2. What assumptions has the competitor made about itself, our company and offerings, and the marketplace? Are these assumptions different from ours?

3. What strengths does the competitor believe it has and what are its weaknesses? What might the competitor believe our strengths and weaknesses to be?

A Price War involves successive price cutting by competitors to increase or maintain their unit sales or market share. Happens when:

*Managers lower price to improve market share, unit sales, and profit

*Competitors match the lower price

*Expected share, sales, and profit gain from initial price cut are lost

To avoid a price war, managers should consider price cutting only when:

1. The company has a cost or technological advantage over its competitors

2. Primary demand for a product class will grow if prices are lowered

3. The price cut is confined to specific products or customers and not across-the-board

Conclusion

For many consumers, price seems to change with a one-way ratchet set to "up." However, economists argue that price is actually set by market forces, balancing supply and demand in order to optimize output with minimal waste. Although it may seem that prices are set randomly, economists explain that price determination is a rational process calculated in a straightforward manner.

The final sale price of a good or service can be affected by factors other than supply or demand. For example, the government may impose special taxes that are added to the list price at the time of sale. Some states set mandatory minimum prices for controlled products like alcohol. Governments also monitor retailers for signs of collusion and price-fixing. For example, if there are two sellers of milk in a small town, they could agree to both charge the same high price for the milk in order to increase their profits. However, this practice is illegal under federal law and, if found guilty, the retailers could face substantial penalties.

Control questions:

1. Can you give the definition of price?

2. Give more information about variable-cost pricing.

3. What do you know about pricing and competitive interaction?

4. Give the information about markup pricing.

5. What do you know about pricing considerations?

Literature

1. English for economists and managers: textbook/ O. V. Ulyanov, S. V. Grishin; yurginskiy technological Institute. – Tomsk: Publishing house of Tomsk Polytechnic University-theta, 2011. – 111 p.

2. Besanko D.A, Brauetugam R.R, Gibbs M.J Microeconomics,2011, Chicago

3. Griffiths A, Wall S.Economics for business and management,2011, England

4. Varian H.R. Intermediate microeconomics,2010, University of California at Berkeley

5. Boyd, W. Harper. Marketing Management.- Boston, 2010

2017-11-30

2017-11-30 392

392