A wage is monetary compensation (or remuneration, personnel expenses, labor) paid by an employer to an employee in exchange for work done. Payment may be calculated as a fixed amount for each task completed (a task wage or piece rate), or at an hourly or daily rate (wage labour), or based on an easily measured quantity of work done.

Wages are part of the expenses that are involved in running a business.

Payment by wage contrasts with salaried work, in which the employer pays an arranged amount at steady intervals (such as a week or month) regardless of hours worked, with commission which conditions pay on individual performance, and with compensation based on the performance of the company as a whole. Waged employees may also receive tips or gratuity paid directly by clients and employee benefits which are non-monetary forms of compensation. Since wage labour is the predominant form of work, the term "wage" sometimes refers to all forms (or all monetary forms) of employee compensation.

30)The factors that influence the level of wage

Most people work to earn a living, which they do by supplying their labor in return for money. Laborers consist of unskilled workers, blue and white collar workers, professional people, and small business owners.

Wages are the price that workers receive for their labor in the form of salaries, bonuses, royalties, commissions, and fringe benefits, such as paid vacations, health insurance, and pensions. The wage rate is the price per unit of labor. Most commonly, workers are paid by the hour. For instance, in 2011, the legal minimum wage rate for most employees in the United States is $7.25 per hour. Earnings equals the wage rate multiplied by the number of hours worked, so an employee earning minimum wage and working the typical 40-hour week earns $7.25 × 40 = $290 per week = $15,080 per year.

Nominal wage is the amount earned in terms of dollars or other currency, while the real wage is the amount earned in terms of what it can actually buy. If the nominal wage does not increase as much as the inflation rate, then real wages decline.

Wage Levels

Wages differ among nations, regions, occupations, and individuals. Generally, wages will be higher where the demand for labor is greater than the supply. Nominal wages vary more than real wages, since the purchasing power of different currenciesvaries considerably. For instance, in countries with low-priced labor, such as China and India, household goods and services have lower prices than in more advanced economies.

The main factor that determines the upper limits of wages is the productivity of the business in combining inputs to produce socially desirable outputs. Obviously, more productive workers can be paid more. Productivity largely depends on the availability of real capital, in the form of machinery and automation, and on the availability of natural resources, which are required as inputs in the production of products and services.

The amount of education or training also largely determines how much a worker can earn, not only by making the worker more productive but by also making the worker more desirable to employers, who compete for workers through the level of wages that they offer. If the time required for training or education is long, then it must lead to higher paying jobs; otherwise, people would pursue easier work or work that can be attained in less time if there was no difference in pay.

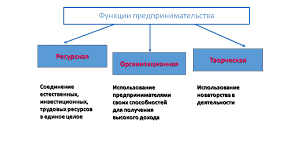

The quality of the entrepreneurs who start a business will also determine the efficiency of the business since they lay down the initial organization of how the business will be conducted to produce its output from its various inputs. Afterwards, the quality of the managementwill affect the efficiency of the business, and therefore, the workers, by how effectively they control costs and produce the desired output.

|

|

|

31)Interest as an income of capital owner

Capital and interest, in economics, a stock of resources that may be employed in the production of goods and services and the price paid for the use of credit or money, respectively.

Capital in economics is a word of many meanings. They all imply that capital is a “stock” by contrast with income, which is a “flow.” In its broadest possible sense, capital includes the human population; nonmaterial elements such as skills, abilities, and education; land, buildings, machines, equipment of all kinds; and all stocks of goods—finished or unfinished—in the hands of both firms and households.

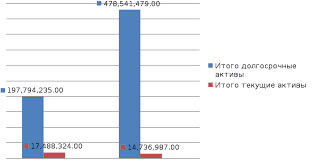

In the business world the word capital usually refers to an item in the balance sheet representing that part of the net worth of an enterprisethat has not been produced through the operations of the enterprise. In economics the word capital is generally confined to “real” as opposed to merely “financial” assets. Different as the two concepts may seem, they are not unrelated. If all balance sheets were consolidated in a closed economic system, all debts would be cancelled out because every debt is an asset in one balance sheet and a liability in another. What is left in the consolidated balance sheet, therefore, is a value of all the real assets of a society on one side and its total net worth on the other. This is the economist’s concept of capital.

A distinction may be made between goods in the hands of firms and goods in the hands of households, and attempts have been made to confine the term capital structure to the former. There is also a distinction between goods that have been produced and goods that are gifts of nature; attempts have been made to confine the term capital to the former, though the distinction is hard to maintain in practice. Another important distinction is between the stock of human beings (and their abilities) and the stock of nonhuman elements. In a slave society human beings are counted as capital in the same way as livestock or machines. In a free society each man is his own slave—the value of his body and mind is not, therefore, an article of commerce and does not get into the accounting system. In strict logic persons should continue to be regarded as part of the capital of a society; but in practice the distinction between the part of the total stock that enters into the accounting system, and the part that does not, is so important that it is not surprising that many writers have excluded persons from the capital stock.

|

|

|

2018-02-13

2018-02-13 790

790