Collecting bad debts is one of the most difficult affairs in the work of the Accounts Department. Retail business is usually done on a cash basis, & wholesale business is done on credit, given for 30 days. Any company prefers to receive long credit from its suppliers.

For each sale an invoice is sent to the customer. It’s the list of the goods delivered & amount owed. At the end of the month each customer is sent an account, showing the total amount due.

Sometimes debtors cannot repay a credit, for example, in case of bankrupt of the company or dishonesty of the people, running it.

Accounts not paid in time are called overdue accounts. In very difficult cases a firm employs a professional debt collector. No company wants to get a reputation for being a bad payer, because it will be difficult to get supplies on credit. There are special agencies, which provide information about the financial situation of any company, so the suppliers can judge a credit risk.

Bush&Green had owed H&G 700 pounds for office furniture for over 9 months. H&G sent their representative to find the debtors and collect the debt. H&G should not put a professional debt collector on because there was a risk of losing a customer.

Insuarance for a private company

Every firm insures itself against loss or damage to its property. Harper & Grant's insurance brokers had arranged a blanket insurance with a syndicate of Lloyds underwriters. Blanket insurance means insurance which covers everything, a comprehensive policy. Harper & Grant make a statement at the end of an accounting period of the total value of all goods handled. The premium is then paid as a percentage of the total value of goods.

Some weeks ago a lorry carrying Harper & Grant's goods was hi-jacked on the road. When the lorry was found abandoned, with its spoiled load of office furniture, the adjusters came in. The underwriters employ a firm of adjusters whose job is to assess or value the loss or damage. The sum they give will not usually be as much as the full insured value of the goods or property. They will take into account, among other things, the depreciated value.

When a company, or a person, takes out an insurance policy it is very often an all-risks policy, that is, it insures the goods or property against almost anything that could happen. But most insurance companies put in some exceptions, like outbreak of war or some other force-major. When an accident or robbery takes place the injured party puts in a claim to the insurance company. If the insurance company agrees to pay it is said to meet the claim.

Types of securities

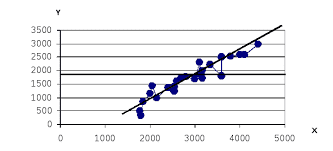

First of all, we should make out the difference between “stocks”, “shares” and “securities”. In a nutshell, in Britain stock is used to refer to all kinds of securities, including government bonds. The word equity or equities is also used to describe stocks and shares. The places where the stocks and shares of listed or quoted companies are bought and sold are called stock markets or stock exchanges.

Also, shares are certificates representing part ownership of the company. Let’s get this right from the start. Ownership in the company is divided among stockholders or share holders. The original shareholders are the people who started the business, but now they have sold shares of the profits to outsiders. By selling these entitlements to share in the profits, the business has been able to raise new funds. Then everybody can easily buy into the company.

For public companies the shares or stocks can be resold on the stock exchange to anyone prepared to pay the going price. Even the largest company occasionally needs to issue additional new shares to raise money for especially large projects. Then to buy into the company, a shareholder must purchase shares on the stock exchange. As a reward for this initial outlay, shareholders earn a return in two ways. First, the company makes regular dividend payments, paying out to shareholders that part of the profits that the company does not wish to re-invest into business. (Example: if you buy company X shares for 600 euro each and then everyone decides its profits and dividends will be unexpectedly high, you may be able to resell the shares for 650 euro, making capital gain of 50 euro on the transaction, but if the company suffers a loss or goes bankrupt, the most they can lose is the money they originally spent buying shares.

There are common or ordinary shares, and preference shares or preferred stock. Holders of preference shares receive a fixed dividend that must be paid before holders of ordinary shares receive a dividend. So, holders of preference shares have more chance of getting some of their capital back in the case of bankruptcy. They are repaid before other shareholders, but after owners of bonds and other debts.

The dictionary describes securities as “a certificate attesting credit, the ownership of stocks or bonds, or the right to ownership connected with tradable derivatives. Security indicates either an ownership position in a corporation(a stock), or a creditor relationship with a corporation or a governmental body(a bond) or rights to ownership, such as those, represented by an option, subscription right or warrant. Thus, bonds guarantee to repay their face value after a certain number of years and pay a fixed rate of interest to the bond-holder in the meantime. The price written on the share, the nominal value, is hardly ever the same as the price it is currently being traded on the stock exchange. The market price depends on supply and demand and can change every minute during trading hours. Traders in stocks quote bid(buying) and offer(selling) prices. The spread or difference between these prices is their profit. Actually, it’s a contract giving the holder a right to buy a designated security(this is a call option) or sell it(this is a put option) at or within a certain period of time at a specified price. In a number of companies apart from salary an executive’s compensation package can include share options, the right to buy the company’s shares at an advantageous price. It’s a kind of benefits or perks.

2018-02-14

2018-02-14 1143

1143