New product development that coordinates efforts across national markets leads to better products and services, but this development varies greatly from country to country.

Japanese companies, for example, tend to believe much more in getting new products to market and then gauging the reaction to them. The product itself may have been developed with reference to observations of present and potential customers rather than conventional market research. US companies on the other hand, tend to use more formal market research methods. And for German companies, product development schedules tend to be more important.

Clearly, companies decide on different launch strategies for different categories of products. The launch decision also includes marketing-mix decisions. The promotional, pricing and distribution strategies also differ from country to country.

The introducing of the Internet and Intranets has the potential to accelerate the process of mining all markets for relevant information and for features that can be included in new products. Numerous companies investigate the possibilities of melding product ideas arising from different countries.

As we now, there is a popular tendency of brand extension which helps to seize opportunities to extend the brand name into new areas. Also there is one interesting low-risky strategy which avoids the huge costs of new product development and offers variation on an existing purchase by adding new flavours or extra services.

Instead of building its own new products, a company can buy another one and its established brands.

In recent years, many companies have used “me-too” product strategies – introducing imitations of successful competing products. Me-too products are often quicker and less expensive to develop, but they need to battle with a successful and well-known competitor.

Many companies turn to reviving once-successful brands that are now dead or dying. Reformulating, repositioning an old brand can cost much less than creating new brands.

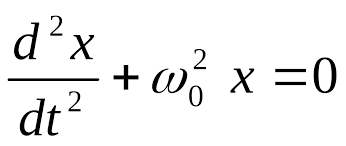

Decisions about the Gearing of the Company (2.5.4-7)

The greater the proportion of long term debt, the more exposed the company is in times of economic difficulty. This is connected with making decisions about the gearing of the company.

When а company is said to be "high geared", the level of borrowing is high when compared to its ordinary share capital. А low-geared company has borrowings which are relatively low. High gearing has the effect of increasing а company's profitability when the company's trading is expanding; if it slows down, then the high interest charges associated with gearing will increase the rate of slowdown. There will also be a drop in profits if working capital is raised without a corresponding rise in production or margins.

We can distinguish between permanent and temporary working capital. The former keeps the business flowing throughout the year, while the latter is needed from time to time to take account of seasoned, cyclical or unexpected fluctuations in the business. The temporary working capital is usually serviced from an overdraft facility.

If inventories are not well managed there will be an enormous amount of excess working capital. This is the job of financial manager to minimize the stocks of raw materials, the level of the work in progress and the quantity of finished goods.

His task is also to see that generous credit terms are negotiated with suppliers but minimal credit is offered to customers.

It is often referred to as debtor side, because working capital is required to finance the gap between payment due to suppliers and payment owed by customers. A balance must be achieved between getting and giving good credit terms in order to attract customers and maintain positive relationships on the one hand, and minimizing cash outlay on the other hand.

Another thing is that adequate cash should always be available for meeting the company’s day-to-day debts and there should always be a reserve on hand to meet contingencies.

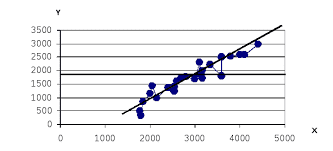

The expected cash flows that will result from potential investment projects should be measured carefully.

2018-02-14

2018-02-14 1972

1972