Taxes in Kievan Rus’: Poliudie and Povoz

In the Ancient Russia the tax was called “tribute”. Initially, the tribute was a tax in kind or financial form levied by winners on conquered tribes (sometimes the tribute was paid at the approach of the enemy forces in order to avoid war).

In the Ancient Russia the tax was called “tribute”. Initially, the tribute was a tax in kind or financial form levied by winners on conquered tribes (sometimes the tribute was paid at the approach of the enemy forces in order to avoid war).

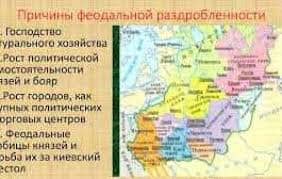

According to written records, a tribute is known in Russia since the IX century, when the princes, after conquering the tribes, levied on them a tribute.

In the Russian state there was no division between Grand Prince income and proceeds which served to meet public needs. The income consisted of war trophies, revenues from lands that belonged to subject tributes, trade, and service fees.

One of the main tasks of the prince was collection of the tribute. There were two main ways of gathering the tribute:

Poliudie, i.e. the process of collecting tribute in Kievan Rus’ by the sovereign from vassal tribes;

Povoz, i.e. the duty of the peasants to deliver agricultural products to the designated place at the designed hour and provide the officials with horse-drawn carts.

READING COMPREHENSION

Make up the summary of the text using the questions to organize your answer:

1. What is the tribute? Which forms of tribute do you know? When did it appear in the Ancient Russia?

2. Was there any division between Grand Prince income and proceeds for public needs?

3. What did the tribute consist of?

4. Which main ways of gathering the tribute in Kievan Rus’ do you know?

5. Which was one of the main tasks of the prince?

Vocabulary notes

tribute дань

tax in kind налог в натуральной форме

written records летопись

proceeds доходы, выручка

public needs государственные нужды

revenues поступления

service fees плата за услуги

UNIT 2

PART 1

TOPIC FOCUS: The Russian tax system

Discuss these questions with a partner.

1. What do you know about the history of Russian tax system?

2. Are there any milestones in the Russian tax system?

3. What can you say about tax reforms in Russia?

Exercise 1.

Practice reading the following words and collocations.

a) adjustments; ad hoc; although; capitalization; compliance; conducive; disproportionately; employees; equalizing; frequent; GDP; hamper; inconsistency; major adjustments; meaningful; merchandise; offset; ratio; thresholds; throughout; uncertainty; uneven;

b) corporate profits taxes; court rulings; excise taxes; foreign origin; income taxes; inadequate automation; interest expenses; luxury items; major revenue source; pricing controls; prescribed limit; real estate transactions; quoted securities; substantive provisions; tax arrears; tax authorities; tax burden; tax-eligible; tax evasion; tax exemptions; tariff rate; tariff schedule; tax-collection system; tax revenue; total revenue; uneven compliance and accounting rules; value-added tax;

c) accrued on; be captured by; be classified as; derive from; distort; eliminate; enact; expand; spell out; streamline; undermine; undergo.

2020-09-24

2020-09-24 215

215