M1 - cash

Urgent checking accounts can be transferred to the investor call non-urgent and used as non-cash.

Most appropriate at the present time is "near money" - M2:

|

|

The third official definition M3 assumes the company owned by large (up to 100 thousands U.S or more) in the form of bank deposits of certificates that can easily apply to the checking deposits.

|

In the presence of demand and supply forms the money market.

Money market - a market where the quality of the product are the money as cash and non-cash.

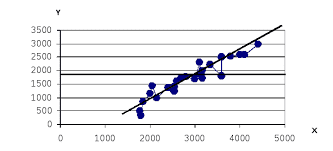

Consider the money market and to determine the equilibrium interest rate - (%).

|

|

М

Fig. 26. Restoring the balance in the money market

Price is the equilibrium interest rate (%) at E.

Sm - the money supply as the total amount of M1.

1) Assume that the amount of money supply decreased from 15 to 10 billion dollars more than the number required by the proposed $ 5 billion under the previous% = 3.

To adapt to the lack of money, people will sell part of the financial assets at a higher price (example - 4%), which will lead to the equality of supply and demand.

Conclusion: The decrease in the price of the bond will increase the interest rate.

2) Assume the market increases the money supply from 15 to 20 billion dollars in the same% = 3.

People are encouraged to get rid of money, buying bonds, increasing the demand for them, thus increasing and price.

Conclusion: The increase in bond prices will lower the interest rate.

So, considering the money market, we see that the demand and supply of money are in constant motion, the balancing is provided only to a certain structure of the financial system.

2014-02-02

2014-02-02 246

246