| value | ценность |

| transaction | дело, сделка, операция |

| a means of exchange | средство обмена |

| a store of value | средство сохранения стоимости |

| a constant store of value | постоянное накопление стоимости |

| to back (paper money, currency) | поддерживать, обеспечивать (бумажные деньги, валюту) |

| store | запас |

| the store of gold | золотой запас |

| currency | 1) деньги (обычно наличные деньги: монеты, банкноты); 2) валюта |

| national currency | национальная валюта |

| the gold standard | золотой стандарт |

| to abandon the gold standard | отказаться от золотого стандарта |

| to issue | выпускать, пускать в обращение |

| to issue paper notes (securities) | выпускать бумажные деньги (ценные бумаги) |

| authorized | официально принятый, разрешенный, санкционированный |

| authorized banks (institutions) | банки (институты), наделенные определенными правами; уполномоченные банки |

| legal tender (banknotes) | законное платежное средство, официально принятое государством |

| cheque | чек |

| a money order | платежное поручение |

| substitute money | представить платежное поручение |

| instruments of credit | кредитные обязательства (векселя, чеки, облигации) |

| assets | 1) активы; 2) средства, капитал, фонды |

| the value of money | стоимость денег |

| a medium of exchange | 1) средство обмена, расчета; 2) средство обращения (как функция денег) |

| purchasing power | покупательная способность |

| to reckon | подсчитывать, исчислять |

| to effect | осуществлять, совершать |

| to effect business transaction | осуществлять деловые сделки |

| circulation (of money, capital) | обращение денег, капитала |

| to come into general circulation | поступать в совокупное обращение |

| the demand for money | спрос на деньги |

| the supply of money (money supply) | 1) денежная масса, сумма денег в обращении, количество денег; 2) предложение денег |

| the quantity of business | количество операций, объем бизнеса |

| the rapidity of business | скорость осуществления операций в бизнесе |

a. Choose the correct alternative to complete each sentence:

1. Money in notes and coins is called:

a) cash; b) capital; c) reserves.

2. The dollar, the mark and the yen are all:

a) currencies; b) funds; c) monies.

3. Money borrowed from a bank is a:

a) deposit; b) income; c) loan.

4. Borrowed money that has to be paid back constitutes a:

a) debt; b) fund; c) subsidy.

5. All the money received by a person or a company is known as:

a) aid; b) income; c) wages.

6. The money earned for a week's manual work is called:

a) income; b) salary; c) wages.

7. The money paid for a month's (professional) work is a:

a) loan; b) salary; c) wages.

8. Money placed in banks and other savings institutions constitutes:

a) capital; b) deposits; c) finance.

9. Money paid by the government or a company to a retired person is a:

a) pension; b) rebate; c) subsidy.

10. The money that will ultimately be used to pay pensions is kept in a:

a) budget; b) deposit; c) fund.

11. The money needed to start a company is called:

a) aid; b) capital; c) debt.

12. The money paid to lawyers, architects, private schools, etc. is called:

a) fees; b) instalments; c) wages.

13. Regular part payments of debts are called:

a) deposits; b) loans; c) instalments.

14. Part of a payment that is officially given back (for example, from taxes) is called a:

a) gift; b) instalment; c) rebate.

15. Estimated expenditure and income is written in a:

a) budget; b) reserve; c) statement.

16. A person's money in a business is known as his or her:

a) deposit; b) fund; c) stake.

17. Money given to producers to allow them to sell cheaply is called a:

a) loan; b) rebate; c) subsidy.

18. Money given to developing countries by richer ones is known as:

a) aid; b) debt; c) subsidy;

Remember that subvention is not an English word.

b. Choose the correct alternative to complete each sentence:

1. If you possess something, you can say that you........... it.

a) owe; b) own; c) owner.

2. If you have to reimburse or repay someone, you........... money.

a) owe; b) own; c) yield.

3. To let someone else have the use of your money for a certain period of time, after which it must be paid back, is to............

a) borrow; b) lend; c) credit.

4. To take money that has to be repaid is, on the contrary, to............

a) borrow; b) lend; c) steal.

5. An amount of money lent is a............

a) debit; b) debt; c) loan.

6. A person who has borrowed money is a............

a) creditor; b) debtor; c) owner.

7. Another word for a lender is a/an............

a) creditor; b) debtor; c) owner.

8. The income received by someone who lends money is called............

a) dividends; b) interest; c) interests.

9. The borrower has to pay back the loan itself, also known as the............

a) principal; b) principle; c) premium.

10. The amount of money a lender receives for a loan or an investment, expressed as a percentage, is known as its return or............

a) credit; b) income; c) yield.

11. The following famous quotations are about credit and borrowing and lending. Can you complete them:

a. In business, one way to obtain........... is to create the impression one already has it.

b. Neither a........... nor a........... be.

c. An acquaintance is someone we know well enough to........... from, but not well enough to........... to.

d. A........... card is an anaesthetic which simply delays the pain.

Remember that lend is an irregular verb: lend - lent - lent

c. Insert the words in the boxes in the following paragraphs:

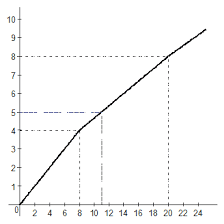

Bonds, commercial, monetarist, prices, tight, velocity

Following the (1)........... argument that the average level of (2)........... and wages is determined by the amount of money in circulation, and its (3)........... of circulation, many central banks now set money supply targets. By increasing or decreasing the money supply, the central bank indirectly influences interest rates, demand, output, growth, unemployment and prices. The central bank can reduce the reserves available to (4)........... banks by changing the reserve requirements. This reduces the amount of money that banks can create and makes money (5)........... or scarce.

Alternatively, the central bank can engage in what are called open market operations, which involve selling short-term government (6)........... (such as three-month Treasury bills) to the commercial banks, or buying them back.

d. Now do the same with this paragraph:

Credit, inflation, output, unemployment, interest rates, the exchange rate, aggregate demand

When money is tight,

1............ rise, because commercial banks have to borrow at a higher rate on the inter-bank market.

2............ falls, because people and businesses borrow less at higher rates.

3............ falls, because people and businesses buy less, as they have less money.

4............ falls too, because with less consumption, firms produce less.

5............ rises, because companies are producing and selling less, and so require less labour.

6............ falls, because there is less money in circulation.

7............ will probably rise, if there is the same demand but less money, or if there is higher demand, as foreigners take advantage of the higher interest rates to invest in the currency. Increasing the money supply, by making more reserves available, has the opposite effects.

e. Sentences 1 to 10 make up a short text about Eurocurrencies. Complete each sentence, by taking a middle part from the second box and an end from the third box:

1. A Eurocurrency is any currency held…

2. Thus Eurocurrencies do not necessarily…

3. The Euromarket developed during the Cold War in the early 1950s,…

4. This pool of dollars was later augmented by…

5. The Euromarkets are still concentrated in London because…

6. Since banks are not obliged to deposit any of their Eurocurrency assets…

7. Therefore, international companies…

8. Because the United States was, by definition,…

9. Consequently in the early 1980s,…

10. This succeeded in bringing…

a) …American trade deficits, and, after the 1974 and 1979 oil price rises,…

b) …at zero interest with the central bank,…

c) …have anything to do with Europe,…

d) …outside its country of origin,…

e) …some Eurodollar business…

f) …the American government allowed US banks special international banking facilities,…

g) …the one country that could not do Eurodollar business,…

h) …there are fewer governmental regulations there than in most other financial centres,…

i) …using US dollars for trade,…

j) …when the Russians, who were afraid that the Americans might freeze their dollar accounts in New York,…

k) …American banks were losing business.

1) …and because the European time-zone is half-way between those of Japan and the USA.

m) …back to New York City.

n) …millions of "petrodollars" deposited by the newly-rich oil-producing countries.

o) …often prefer to borrow Eurodollars.

p) …so the name is not a very good one.

q) …such as US$ in France, Yen in the US, or Deutschmarks in Japan.

r) …they can give better interest rates (to both borrowers and depositors) than US-based banks.

s) …transferred them to Europe, particularly to banks in London.

t) …without reserve requirements and interest rate limits.

| Sentence 1: | Sentence 6: |

| Sentence 2: | Sentence 7: |

| Sentence 3: | Sentence 8: |

| Sentence 4: | Sentence 9: |

| Sentence 5: | Sentence 10: |

f. Third World Debt. Rearrange the following sentences to make up a coherent and logical text about Third World debt. The first sentence is given to help you:

a. After the second oil shock of 1979, and the economic slowdown that followed it, interest rates rose and the prices of the commodities and agricultural goods exported by the debtor countries fell.

b. All this obviously makes most of the people in these countries much worse off than they were before their governments began borrowing to finance development.

c. Consequently they need to rollover or renew the loans, to reschedule or postpone repayments, or to borrow further money from the International Monetary Fund (IMF) just to pay the interest on existing loans from commercial banks.

d. For these reasons, many of the heavily indebted Third World countries are now unable to service their debts with Western commercial banks: i.e., they cannot pay the interest, let alone repay the principal.

e. In many countries, this worked successfully for a few years, but after the huge rise in oil prices in 1973, while the oil-exporting nations were depositing their "petrodollars" in Western banks, many developing countries needed to borrow more money to pay for their imported oil.

f. In the 1960s, many developing countries with low productivity, low income, and low saving rates began to borrow large sums of money from Western banks, in order to industrialise.

g. In the 1990s, while much of the Third World was paying billions of dollars of interest to the IMF (but hardly reducing the size of the loans themselves), the commercial banks started to lend billions of dollars to the former "Second World" - the previously communist countries of Eastern and Central Europe.

h. In these circumstances, when rescuing or "bailing out" indebted countries, the IMF insists on "structural adjustment" and "austerity" measures, obliging governments to devalue, to privatise as much as possible, to cut spending on health care, education and transport, to end food subsidies,

and to export everything that can be sold, including food.

i. In the late 1980s, many Western banks and governments (but not the IMF) began to write off or cancel a proportion of the loans made to Third World countries which had defaulted, although the proportion cancelled is generally less than the amount that the countries were repaying anyway.

| f |

g. Now complete the following sentences:

1. If you borrow money you have to pay.........

2. When the loan matures you have to pay back the…………..

3. Many developing countries are now heavily... ………..

4. To service a debt is to.....................

5. To default on a debt is to...................

6. To bail someone out is to...................

7. To rollover a debt is to.....................

8. To reschedule a debt is to..................

9. To write off a debt is to....................

h. Time Metaphors. There are a lot of common metaphorical expressions in English which reveal that we think of time as a limited resource or a valuable commodity. We often talk about spending, investing, saving, wasting, and using up time, of having enough time left, or running out of time, of giving somebody your time, of something taking up too much time, of having no time to spare or to lose, of something not being worth our time, and so on. Complete the sentences below using the correct form of the following words:

Save, lose, give, run, waste (x2), spend, left, worth, spare, take (x2), invest, allocate

1. I need a decision fast. We're........... out of time.

2. How much time do we have...........?

3. It's a complete........... of time.

4. Stop........... my time!

5. It'll........... time if we all get a copy of the figures before the meeting.

6. I'd like to help you but I'm so busy, I just can't........... the time.

7. I'm not sure this project is........... the time it's going to take to get it off the ground.

8. Look, we've........... a great deal of time and effort in this. We can't back out now.

9. We need to do something about it straightaway. There's no time to............

10. We obviously need to........... more time for the preliminary study before we take this any further.

11. Why isn't your report finished? You've been........... more than enough time to do it.

12. We had to........... a lot of time getting to know the Saudis before we could get down to negotiations.

13. Don't worry. Everything will work out fine. It's just going to........... a little more time than we expected, that's all.

14. No, you can't have another week to work on it. This has........... up far too much time already.

2015-04-01

2015-04-01 2279

2279