The competence to be formed: ОК-1;ОК-4;ОК-6;ОК-7;ОК-12;PK-1;PK-2;PK-8;PK-9;PK-13

Results of development

To know:

1) the monetary circulation law. Concepts of monetary weight, purchasing capacity of money, speeds of monetary circulation both other aspects and characterizing the monetary circulation law;

2) concept and essence of inflation;

3) the indicators measuring a condition of inflationary processes in economy;

4) monetary and credit policy tools inflations influencing size.

Be able:

1) to Analyze the basic indicators characterizing a condition of inflationary processes in economy;

2) to Reveal the factors influencing a condition of inflation;

3) to Count on the basis of the available data dynamics of inflation and to predict its value;

4) to Analyze historical and methodological aspect of regulation of inflation.

Possess:

1) the Basic methods of an estimation of a condition of inflation in economy;

2) Indicators of a condition of inflation;

3) Methods of the analysis of the factors influencing occurrence of inflation.

Educational methods:

Lectures – 2 hours

Practical training – 4 hours

Independent work – 6 hours

Forms of current control - Poll, the decision of problems, testing

The monetary circulation law. Monetary weight, the sum of the prices of the goods and services, the credit, mutual and non-cash payments, speed of the reference of money and their interrelation. A problem of quantity of the money necessary for the reference. Calculation of quantity of the money necessary for the reference. Monetary weight and requirements of a monetary turn. Concept of purchasing capacity of money. The factors defining quantity of active money. Monetary weight as set of active and passive money. The factors influencing change of volume of monetary weight. Speed of the reference of money. Infringement of the law of monetary circulation and its reason.

Concept and essence of inflation. Inflation as overflow of channels of the monetary circulation, connected with infringement of the law of monetary circulation. A rise in prices and inflation. Loss by money of a part or all functions and inflation. Inflation as difficult social and economic process. Inflation as multiple-factor process. Industrial, monetary, воспроизводственные and social groups of factors of inflation. Extreme forms of inflation. Opened and a hidden inflation. An index of a rise in prices and open inflation. Moderate (creeping), galloping both a hyperinflation and their historical examples. Demand inflation, inflation of the distribution costs, imported inflation. Definition of rates of inflation and factors, on them influencing. Increase in actives of the Central Bank and inflation. Structure of actives of the Central Bank as a determinant of sources of inflation. Credit issue of the Central Bank and increase in monetary base and monetary weight. Logs between change of volumes of monetary weight and a rise in prices. The factors influencing size of a log.

The mechanism of development and inflation measurement. An initial stage of inflation: a parity of monetary weight and the prices. The basic stage of inflation. Overflow of channels of monetary circulation. Growth of weight of money and speed of their reference. Indicators of price indexes.

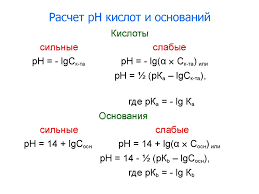

Consumer price index and methods of its calculation. Concept of cost of "basket" of consumer goods and services and its dynamics. Summary CPI in the USA. Calculation CPI in the Russian Federation. A rate of inflation on the basis of calculations CPI. CPI and purchasing capacity of money. A price index of manufacturers (IPM) as an index of change of wholesale prices. Three cores IPM: G.Paashe, E.Laspejresa and I.Fisher's price index. Methods and features of their calculation. Applicability of price indexes of manufacturers. Gross national product deflator as the tool of the statistical analysis of inflation. Methods of its calculation. A cost of living index.

Anti-inflationary policy. Currency reforms and an anti-inflationary policy. Concept of currency reform. Kinds of currency reforms. A nullification. Devaluation. Revaluation. Denomination. Anti-inflationary policy types: the deflationary policy and a policy of incomes. Economic Content the deflationary policy. Methods: decrease in state expenses, increase of interest rates for the credit, increase in taxes. The efficiency analysis of targeting the monetary weight. Concept of inflation targeting and comparison with targeting the monetary weight. A policy of incomes and social contradictions. Social and economic consequences of inflation. Features of inflation in the Russian Federation in 1991-2010 Transition to a mode of inflation tergating in the Russian Federation.

2015-04-30

2015-04-30 627

627